In the complex web of global technology supply chains, one fact stands out: the world’s heavy dependence on China for rare earth minerals (REEs). These essential elements power everything from smartphones and electric vehicles to wind turbines, military hardware, and cutting-edge quantum computers. However, China’s dominant role in rare earth mining and processing has sparked concerns about supply security, geopolitical leverage, and the resilience of critical industries worldwide.

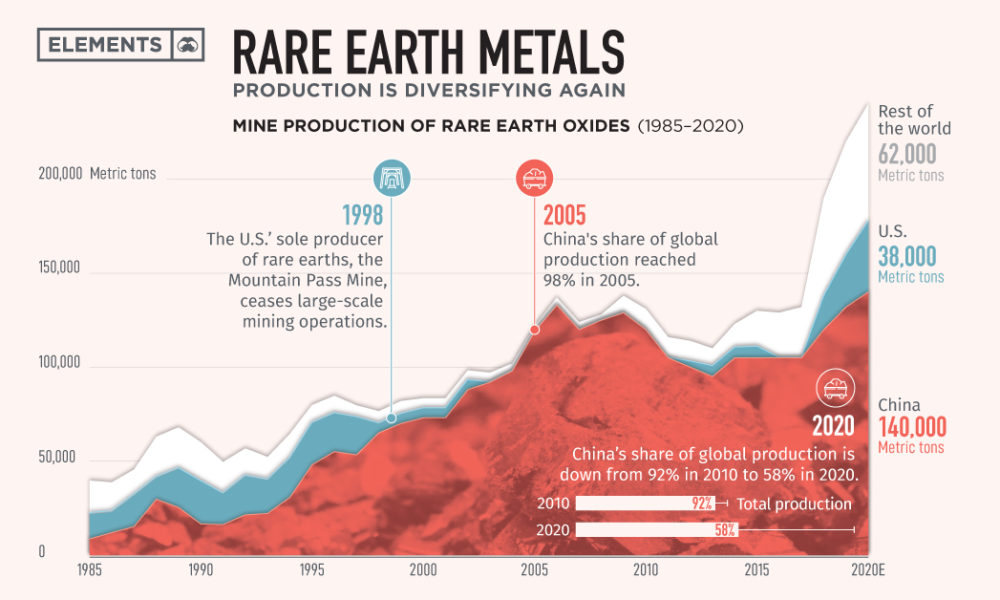

China’s Dominance in Rare Earths: The Numbers

China controls approximately 60-70% of the world’s rare earth mineral production and an even larger share—up to 85-90%—of global rare earth refining and processing capacity. This dominance is not just about mining but includes the entire supply chain from extraction to purified materials used in manufacturing.

This concentration of supply has profound implications, especially since rare earth elements are essential to technologies at the forefront of global innovation and economic growth.

Key figures:

| Stage | China’s Global Share (%) |

|---|---|

| Mining (Raw Ore) | 60 – 70 |

| Refining & Processing | 85 – 90 |

| Export of Rare Earth Metals | 80+ |

While countries like the USA, Australia, Canada, and others have substantial REE deposits, they currently lack the refining infrastructure, which is critical to turning ore into usable materials for industry.

What Are Rare Earth Minerals Used For?

Rare earth minerals include 17 elements known for their unique magnetic, luminescent, and electrochemical properties. Their strategic importance spans multiple high-tech industries:

1. Consumer Electronics

Devices like smartphones, tablets, computers, and flat-screen TVs depend heavily on REEs such as neodymium, europium, terbium, and yttrium. These elements enable bright displays, powerful speakers, vibration motors, and energy-efficient lighting.

2. Electric Vehicles (EVs)

Modern EVs use high-performance permanent magnets made from neodymium, praseodymium, dysprosium, and terbium in their electric motors. These magnets help deliver the torque and efficiency that are key for vehicle performance and range.

3. Renewable Energy

Wind turbines employ rare earth magnets for efficient generators. As countries push for clean energy, demand for these minerals is growing rapidly.

4. Defense and Aerospace

Rare earths are critical for missile guidance systems, radar, jet engines, lasers, and other advanced military technologies. Their unique magnetic and optical properties enable precision and durability under extreme conditions.

5. Quantum Computing & AI

As AI hardware and quantum computing advance, rare earths such as ytterbium, europium, and cerium are vital for qubits, lasers, cooling systems, and optical components.

6. Catalysts and Industrial Applications

REEs are used in automotive catalytic converters to reduce emissions, as well as in petroleum refining and glass manufacturing.

Why Is China So Dominant?

Several interrelated factors have propelled China to the forefront of the rare earth industry:

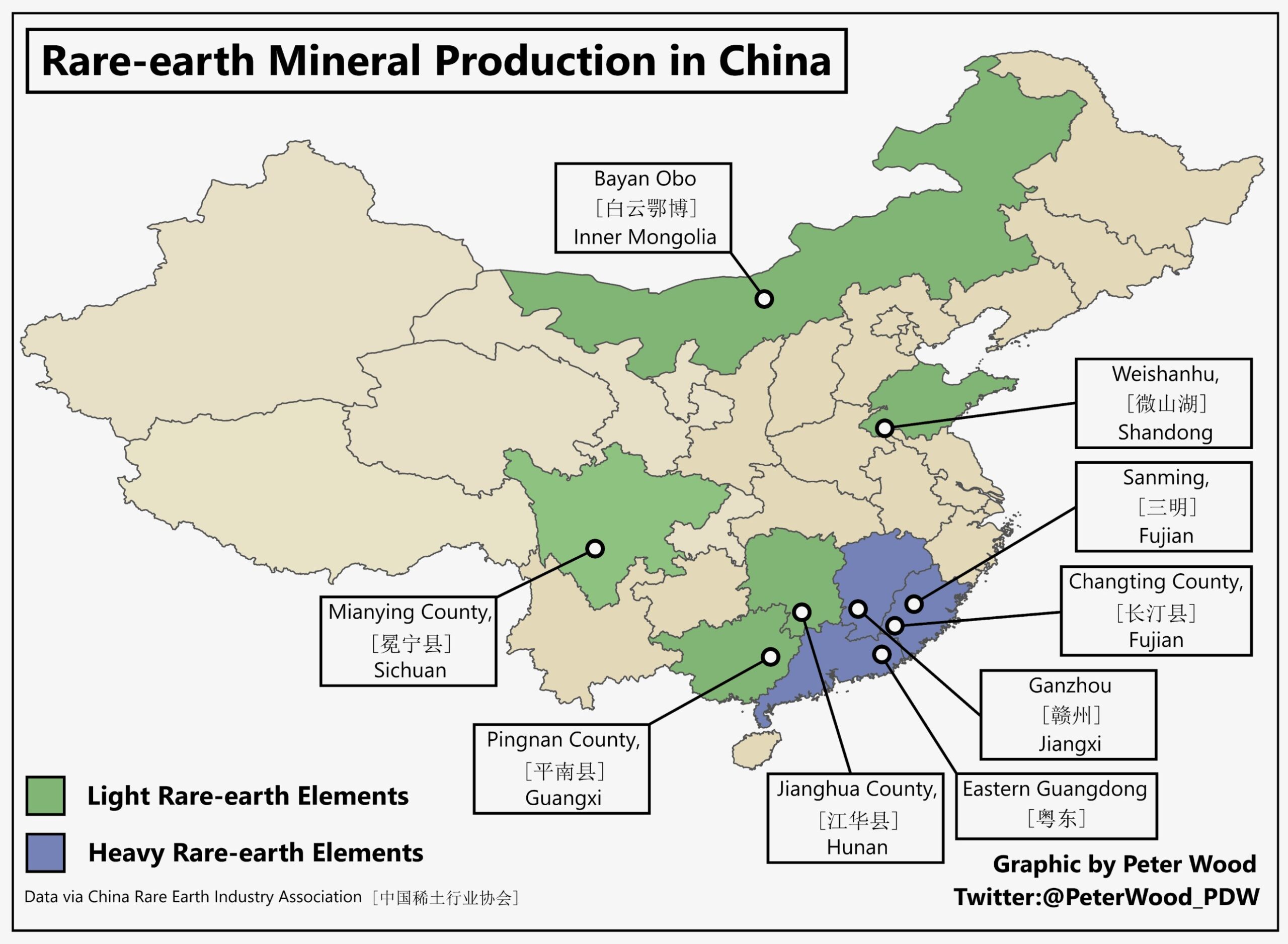

Large, Accessible Deposits

China’s Bayan Obo mine in Inner Mongolia is the largest rare earth deposit in the world, containing billions of tons of ore. Other deposits are also significant but less accessible.

Lower Production Costs

Historically, China’s less stringent environmental and labor regulations allowed cheaper mining and processing costs, undercutting global competitors.

Vertical Integration and Processing Capacity

China has invested heavily in downstream processing facilities that convert raw ores into high-purity materials usable by manufacturers worldwide. Processing is a technically complex and costly stage, and outside China, refining capacity is scarce.

Strategic Government Support

Chinese government policies have consistently supported the rare earth industry through subsidies, export quotas, and stockpiling strategic reserves. This long-term strategy has ensured China’s dominant market position.

Global Impact and Geopolitical Risks

China’s dominance of the rare earth supply chain poses several risks:

Supply Vulnerabilities

The global economy’s reliance on a few key mines and processing plants in China makes supply chains fragile. Any disruption—whether political, environmental, or logistical—can lead to shortages or price spikes.

In 2010, a diplomatic dispute between China and Japan led to an unofficial rare earth export embargo, causing global panic and price surges. Though the situation has since stabilized, it remains a cautionary example.

Strategic Leverage

China can use its control over rare earths as leverage in international trade negotiations or geopolitical conflicts. Countries reliant on these minerals for critical infrastructure and defense technologies are particularly vulnerable.

Price Volatility and Market Uncertainty

Concentration in supply creates price instability, complicating budgeting and investment decisions for manufacturers across sectors.

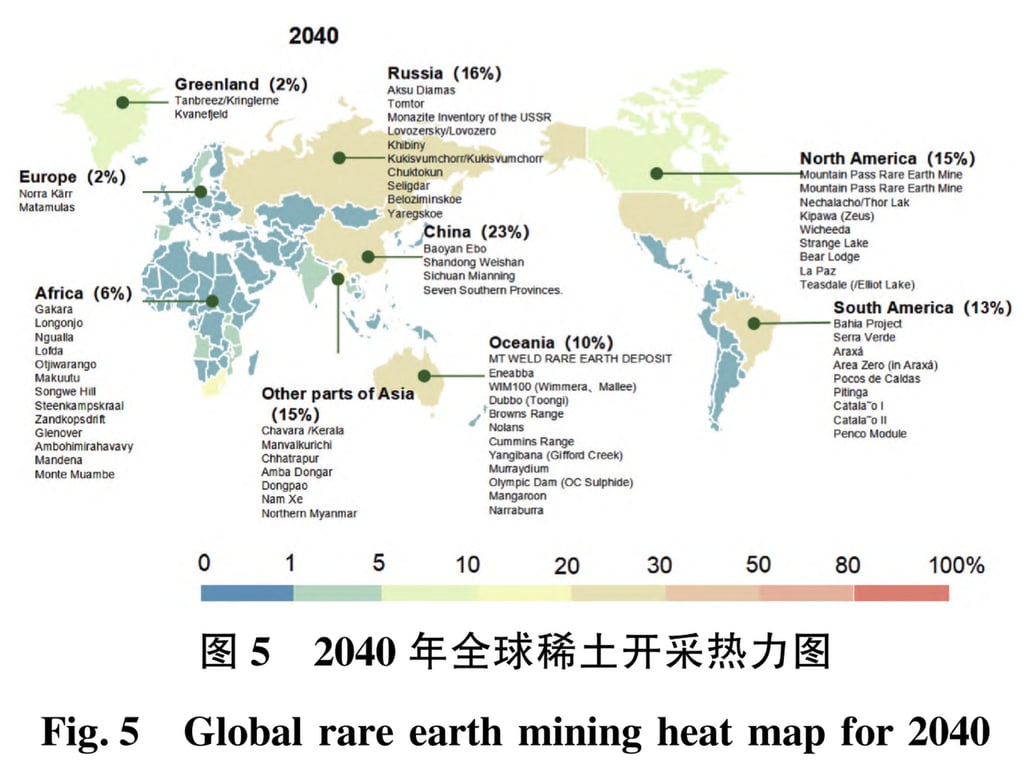

Efforts to Diversify and Reduce Dependence

Recognizing the risks, many countries and companies have begun to act:

Developing Domestic Mining and Processing

- The USA’s Mountain Pass mine in California is expanding production and partnering with processing companies to build local refining capabilities.

- Australia’s Lynas Corporation is a major rare earth producer with plans to expand refining facilities both domestically and abroad.

- Canada and several European nations are investing in exploration and pilot refining plants to jump-start their own supply chains.

Recycling and Urban Mining

Recovering rare earths from discarded electronics (urban mining) is gaining traction. Technologies to economically extract REEs from waste streams could supplement primary mining.

Researching Alternatives

Scientists are exploring REE-free magnets and substitute materials for critical applications, but none yet match the performance of neodymium-based magnets at scale.

Forming Strategic Alliances

Countries including the USA, Japan, Australia, and members of the EU are collaborating on supply chain security, sharing resources, and co-investing in extraction and refining technologies.

Summary of China’s Rare Earth Supply Influence by Sector

| Application Sector | China’s Share of Supply Reliance (%) |

|---|---|

| Electronics | 70 – 80 |

| Electric Vehicles | 80 – 90 |

| Renewable Energy | 75 – 85 |

| Defense & Aerospace | 60 – 70 |

| Advanced Computing | 85 – 90 |

The Road Ahead

China’s grip on rare earth minerals remains a strategic vulnerability for global industries. While efforts to diversify sources and develop recycling are accelerating, building resilient supply chains and processing infrastructure will require years of investment.

In the meantime, global industries and governments must balance near-term dependence with long-term plans for sustainability and security. Rare earths may be small in quantity but loom large in their impact—shaping the future of technology, national security, and economic power.

China’s Recent Export Controls

In April 2025, China imposed export controls on several medium and heavy rare earth elements, including samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. These materials are crucial for various high-tech applications, such as electric vehicle motors, wind turbines, and advanced electronics. The Chinese government cited national security concerns and international nonproliferation obligations as reasons for these restrictions .(amazingmagnets.com, hklaw.com)

Recent Diplomatic Developments

On June 6, 2025, U.S. President Donald Trump announced that Chinese President Xi Jinping had agreed to resume the export of rare earth minerals and magnets to the United States. This agreement followed a phone call between the two leaders aimed at addressing ongoing trade disputes. China also granted temporary export licenses to rare-earth suppliers working with major U.S. automakers, signaling a potential easing of tensions .(reuters.com)

In parallel, China’s Commerce Ministry announced on June 7 that it would expedite rare earth export license approvals for European Union firms. This move comes after China’s April suspension of rare earth exports disrupted global supply chains. The “green channel” for qualified European applications aims to alleviate concerns over manufacturing delays across various sectors .(reuters.com, ft.com)

Impact on Global Industries

China’s export controls have had a significant impact on global industries. Some European auto parts plants have suspended operations, and companies like Mercedes-Benz are exploring ways to mitigate shortages of rare earths. The restrictions have disrupted supply chains central to automakers, aerospace manufacturers, semiconductor companies, and military contractors worldwide .(reuters.com)

The semiconductor industry, in particular, faces potential production delays and higher costs due to these export controls. Analysts warn that the full effects may be felt as early as 2026 .(eetimes.com)

Looking Ahead

While recent diplomatic engagements suggest a de-escalation of tensions, the situation remains fluid. The global community continues to monitor China’s rare earth export policies closely, given their critical role in modern technology and defense applications.