Despite all the doom, gloom, and wishful thinking from the anti-EV crowd, the numbers paint a narrative of swift expansion in the commercial EV and ZEV (Zero-Emission Vehicle) markets. CALSTART’s latest figures reveal a remarkable 250% growth in the zero-emission heavy truck market.

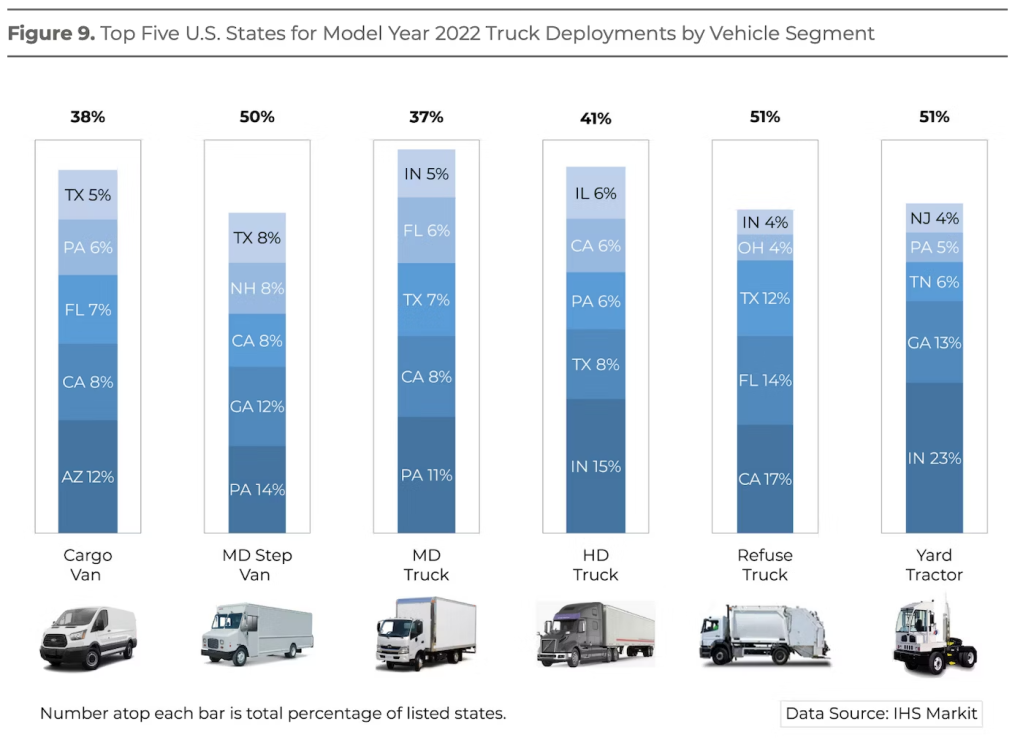

While the challenge of long-haul trucking remains for BEV semi trucks, several commercial fleets have effectively implemented zero-emission trucks (ZETs) in regional delivery or drayage roles. As anticipated, California maintains its position as the leader in heavy ZET deployments across the United States. However, with “just” 3,075 ZETs deployed to date, according to the latest CALSTART report, California represents less than 20% of the total US ZET deployments.

Jessie Lund, CALSTART’s deputy director of truck technology and one of the named authors of CALSTART’s comprehensive “Zeroing in on Zero-emission Trucks” report, expressed some surprise at that fact. “The fact that ZETs have already been deployed in every state, while surprising,” Lund said, “speaks to a strong market for battery-electric trucks.”

E-vans drive commercial EV growth

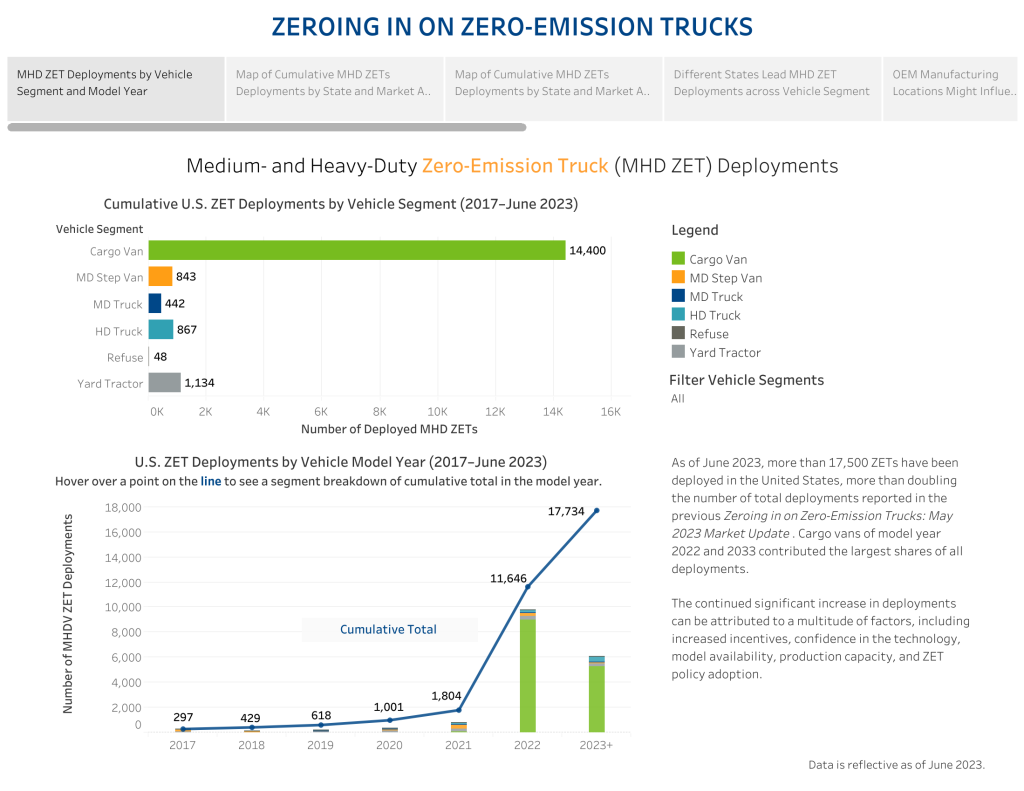

While electric semis like the ones from Tesla and Freightliner tend to grab the headlines, it’s the commercial van segment that’s seeing the most rapid rates of EV adoption. According to CALSTART, the US has seen the deployment of more than 14,000 battery-electric cargo vans, with a significant surge of 11,835 units deployed in the first half of 2023. That is a staggering 461% increase in deployments compared to CALSTART’s previous report.

Commercial EV sales by segment

Following cargo vans with regard to total ZET deployments are yard tractors (1,134), HD trucks (867), medium-duty step vans (843), medium-duty trucks (442), and refuse trucks (48).

“My biggest takeaway from the latest update is just how quickly this market is growing,” explains Lund. “Especially considering the data only covers the first half of 2023, it’s encouraging to see the ‘hockey stick’ exponential growth. Deployments have increased by an order of magnitude since the first iteration of this report (January, 2022) – and all that in spite of a global pandemic, supply chain challenges and economic volatility. This tells me that the market, while still relatively small compared to the overall truck market, has some serious momentum.”

Electrek’s Take

Today, there are more than 160 zero-emission commercial truck models available in the US from more than 40 OEMs. That number continues to grow, too (heck, RAM announced a new commercial e-van, literally while I was typing this), and fleet managers will continue to buy electric vehicles as soon as they become available.

Why? Because fleet managers are focused on the bottom line costs of operating their fleets – and, regardless of their political leanings, EVs cost less to own and operate than comparable ICE models. Until that fact changes, converting whatever assets to they can to electric will remain a no-brainer.

FTC: We use income earning auto affiliate links. More.