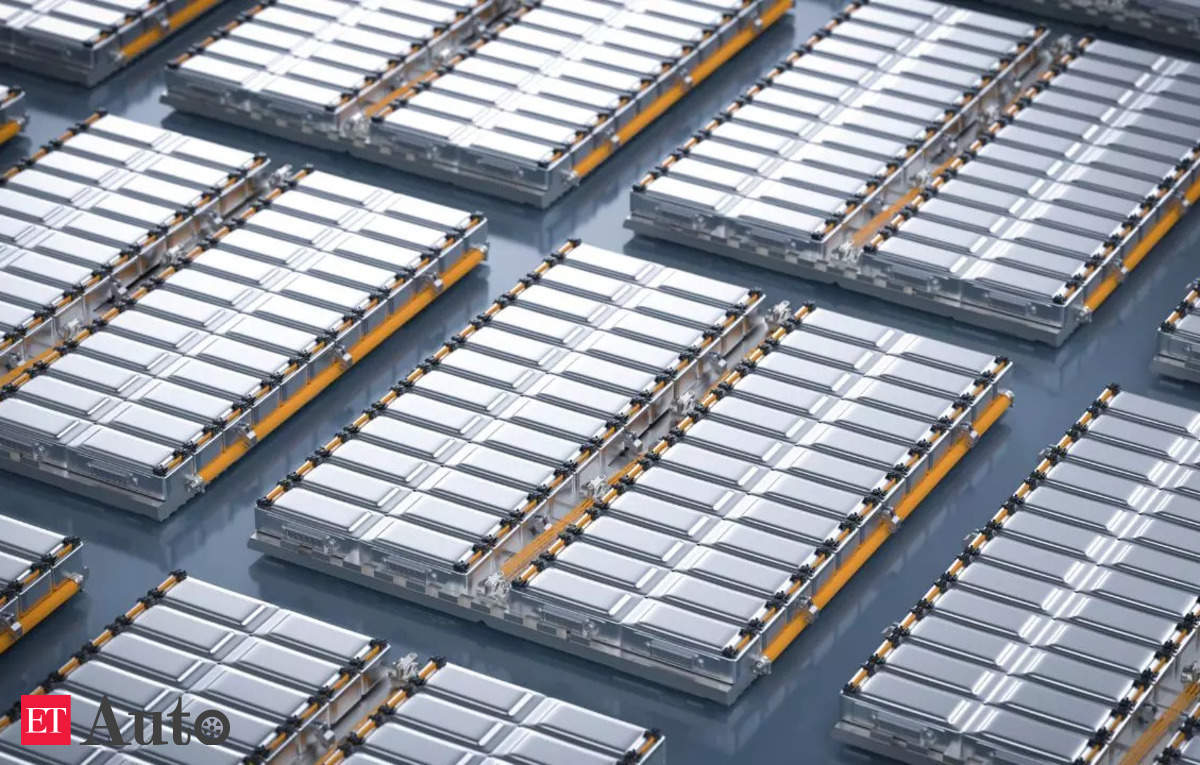

The wave of battery factories under construction around the world will be able to produce far more cells than the global economy needs, BloombergNEF warns in a new report.

Demand for lithium-ion cells is growing fast, as automakers electrify their fleets and utilities install big batteries to stabilize the power grid. But manufacturers have announced so many new factories that capacity will outstrip demand for the rest of the decade, according to BNEF.

By the end of 2025, the global battery industry will be able to produce more than five times as many cells as the world will need that year, BNEF forecasts in its latest Electric Vehicle Outlook.

“This is good news for automakers and EV buyers but marks a challenging time ahead for new entrants to the battery industry,” the report said.

Oversupply is most acute in China, where manufacturing capacity will exceed annual battery demand by at least 400% for the rest of the decade. It’s also an issue in the US, where President Joe Biden has made building a domestic battery supply chain one of his top climate and industrial priorities. Among efforts to woo battery makers, the administration offered a conditional USD 9.2 billion loan to Ford Motor Co. last year to construct three battery factories.

Europe also faces a glut of battery capacity, yet governments are pushing for more. Swedish battery maker Nortvolt AB has a plant under construction in Germany, but the country’s Economy Minister Robert Habeck is already lobbying the company to build another.

Some planned factories around the world may be delayed or canceled due to the industry’s overcapacity, according to Yayoi Sekine, head of energy storage research at BNEF. Ford, for example, has ratcheted back its plans for ramping up electric vehicle production citing a price war for battery-powered cars and trucks.

“This will be a problem everywhere, including the US,” she said in an email.

At the same time, the chemistries used to make batteries are changing. The report found that lithium iron phosphate batteries are gaining popularity for powering electric cars, particularly among Chinese automakers. Their component materials are cheaper than the standard lithium-ion cells that use nickel, manganese and cobalt, and the shift could substantially lower future demand for those metals. BNEF cut its forecast for the amount of nickel used in batteries next year by 25%.