14 July 2025

As EV battery market developments continue, focus is shifting to the beginning and end processes of the journey, and especially skills. Autovista24 special content editor, Phil Curry, reports from the recent Battery Cells and Systems Expo.

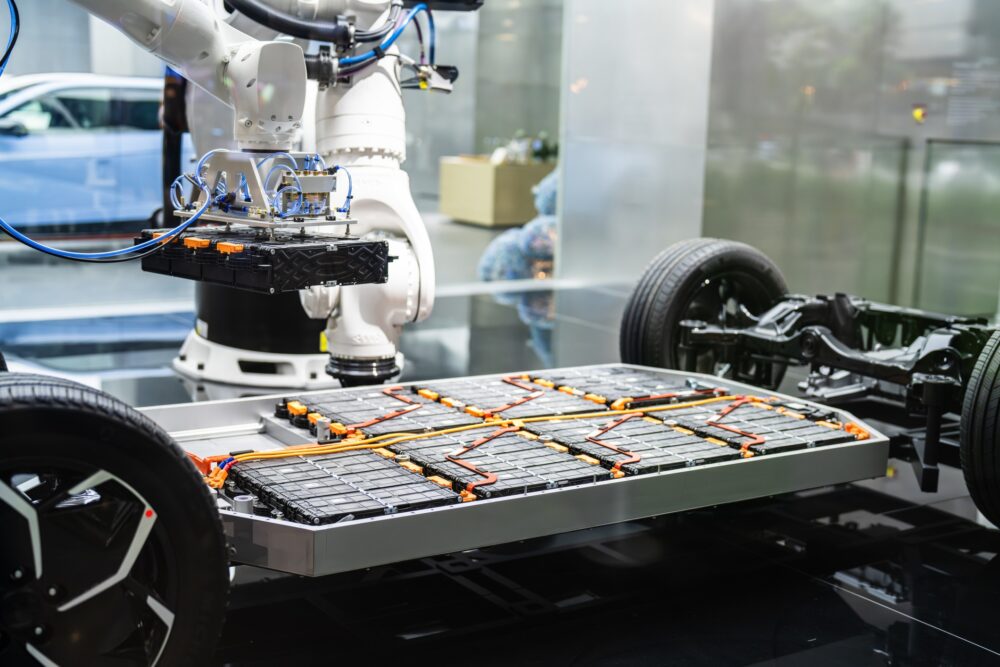

Batteries are perhaps the most important component in an EV. The ability to store and release energy in an efficient manner is critical for driving range and vehicle performance.

As the technology advances, the market expands. Seasoned suppliers and new startups battle for a share, aiming to launch the best products, services, and and supply chains.

This was evident at the recent Battery Cells and Systems Expo, a two-day conference and exhibition held in Birmingham, UK. The event brought together manufacturers, suppliers, academics and users to discuss the growing battery market.

Building on battery skills

While the UK looks to build its battery supply chain, from materials processing to assembly in gigafactories, it needs a workforce dedicated to this task.

Tom Spencer, director at beet Industrial Communications, commented that skills are becoming more important than ever in the battery industry. Around 75% of the supply chain is based in China. This has caused other markets to look at the technology as a sovereign infrastructure capability.

‘The question for the UK market, with gigafactories being built, is where to find staff,’ Spencer told the audience.

Tony Harper, director at Tony Harper Consultancy Services, added that when initial funding was released to the automotive sector in 2017 to develop a battery industry in the UK, little was spent on skills.

‘As we approached the second phase of the build-up plans, it became increasingly clear that it was not tenable for us to support the growth of the industry and not support skills,’ he commented. ‘So we went to those building the gigafactories, and asked them what they needed.

‘They highlighted the fact that thousands and thousands of people would need to be found and trained in a variety of positions to support battery development, manufacturing, and supply.’

Different approaches

Steve Doyle, CEO at EVERA Recruitment, broke down the number of people needed in different areas. He highlighted that the Faraday battery challenge, part of the UK research and innovation challenge fund, identified that 270,000 people will be employed by the EV and battery market by 2040. Of these, 90,000 will be in newly created jobs, and 30,000 of these will be in the gigafactory and supply chain markets.

However, he added that the issues stem from finding the right people to place in these jobs. ‘If you want to recruit for a gigafactory, you cannot recruit from the gigafactory next door, because it does not exist yet,’ he told the audience.

‘You first have to break the manufacturing processes down. You have powder handling, slurries, deposition, coating, calendaring, slitting, electrolyte filling, welding, and so on. And people doing these jobs exist today. While academic institutes are doing a great job of training the next generation, we can recruit for today,’ he went on to say.

Doyle offered additional examples of how existing roles are similar to the workflows needed in EV battery production, such as looking at the coating and deposition sector.

‘We even found that electrolyte filling processes could be linked to a company that was putting soy sauce into sachets,’ he added.

Looking to China

There is also the potential to recruit from China, which has a large number of gigafactories.

‘There are executives in China who understand the market, understand the talent, and speak good English. It is the same with scientists in the country. So let us get some of that knowledge by partnering with China and learn from them,’ Doyle added.

Chinese gigafactories are also run more efficiently, giving the UK a potential insight into how it can develop a more streamlined and skilled workforce. This would fill the skills gap more quickly, whilst reducing costs.

‘Currently, a gigafactory in the western world operates with 100 heads per gigawatt hour. So a 40gWh factory will need 4,000 people. Of those, half will be operatives, 20% will be support staff, and 30% will be the engineers and the scientists,’ he continued.

‘In China, the very efficient gigafactories are now running at 25 heads per gigawatt hour. They also work a 72-hour week, something that is standard in the country. They have a quarter of the staff working twice as many hours. We will never be able to compete with that.

‘So, while we train up a UK workforce, let us assimilate those skills from China into the UK. This is about building a workforce today, bringing in talent, learning from that, and creating around it,’ stated Doyle.

Recycling efforts

While battery development remains in constant flux, attention is increasingly turning to end-of-life challenges as well.

EV batteries will not last forever. Once their state of charge deteriorates below usefulness, they will need to be replaced. As a battery contains potentially toxic materials, it needs to be disposed of carefully.

However, recycling key components not only reduces the environmental impact but could also improve sustainability and reduce raw material requirements.

‘The majority of EVs in the UK today are larger vehicles, such as SUVs. For this reason, the batteries they use will be bigger, and this gives more scope for materials recycling,’ Dr Diogo Vieira Carvahlo, innovation lead for batteries at the Battery Innovation programme, told the audience.

‘However, the overall UK trend is for smaller cars, so whether EVs will follow this path, requiring smaller batteries, remains to be seen.’

‘The main cathode active material for recycling comes from manufacturing scrap at the moment. This trend is likely to continue into 2030. By this point, the UK needs to be able to handle 17kt of battery packs for recycling,’ he outlined.

Carvalho emphasised the need for the UK to handle recycling of battery material itself. This, he added is essential if the country is to play an important part within the global battery market.

‘If the UK wants to have a strong supply of catalytic material in the UK, and become self-sufficient for that, then it will need to ensure that disposed batteries remain in the country, so it can transform some of that ‘black mass’ to this material type. But to ensure it can do this, timing is important,’ Carvahlo stated.

Opportunities ahead

Despite looking at certain materials that would be in high demand, Carvahlo highlighted that the recycling industry needs to cover the entire materials chain.

‘The UK also needs to be able to handle low-value material, which will come into the market very quickly. You may be interested in catalytic materials, but all other elements need to be worked in,’ he noted.

‘It is important not just to look at the battery cells as a big opportunity, but the packs, the modules, the casings and all of that other material that you need to build up.’

There is a need for the battery market to concentrate on certain materials, which can feed back into the manufacturing process. Limitations on these components will mean buying in raw materials and becoming reliant on a larger supply chain.

‘We need to have circular solutions for materials such as copper and aluminium, which are critical to the UK. We will have significant stock shortages of these materials for future EV applications and other electrification opportunities,’ explained Alexander Thompson, battery materials manager at EMR Group.

‘We need to recover these materials at a suitable grade to be able to go back into the original application, rather than downcycling.’

Supporting local demand

Thompson went on to discuss the importance of onshoring, which has become a growing influence in the global political landscape in recent years. Europe has seen an increase in this practice, while the US is pushing for more onshoring, with the introduction of tariffs to bring companies back to the country.

‘In the UK, we need to make sure that we have materials to support that demand from existing gigafactories, but also new players wanting to come into that market,’ he said.

‘We also need to make sure we can cover the rest of the supply chain, sourcing materials from Europe. This is even more important with new directives coming in covering mandated recycled content targets.’

There is also a potential issue surrounding traceability, with a need to ensure that materials used are treated in an ethical manner. ‘We need to make sure that recycled materials are not going to parts of the world where material security will be jeopardised,’ commented Thompson.

‘Also, from an OEM liability perspective, it is important that when batteries do reach the end of their usable life, they are recycled responsibly. All safety aspects must be taken into consideration.’

Materials forecast

The average lifespan of an EV can give an idea of the processes that need to be put in place to build up a resilient supply chain for materials.

‘The average electric vehicle will last for around 10 to 15 years. So we can see today what the battery feedstock will be like in 10 years, and this gives us high certainty on the materials available going forward. It also means we can see what we will need more of in the future,’ Thompson added.

‘But looking at the data today, even if we recycle 100% of that at 100% efficiency, we still do not meet the demand that will be coming. We would not be able to do a fully circular solution until 2040. So we need to work together to bridge that gap and understand how we can utilise recycled content and virgin content together,’ he concluded.