South African chemicals company Omnia Holdings on Monday declared a special dividend as increased demand for explosives, driven by battery metals exploration, boosts the company’s prospects.

Omnia’s after-tax profit was flat at 1.163 billion rand (USD 61.88 million) in the year ended March 31, compared with 1.152 billion the year before, after fertiliser prices came off record highs, impacting earnings.

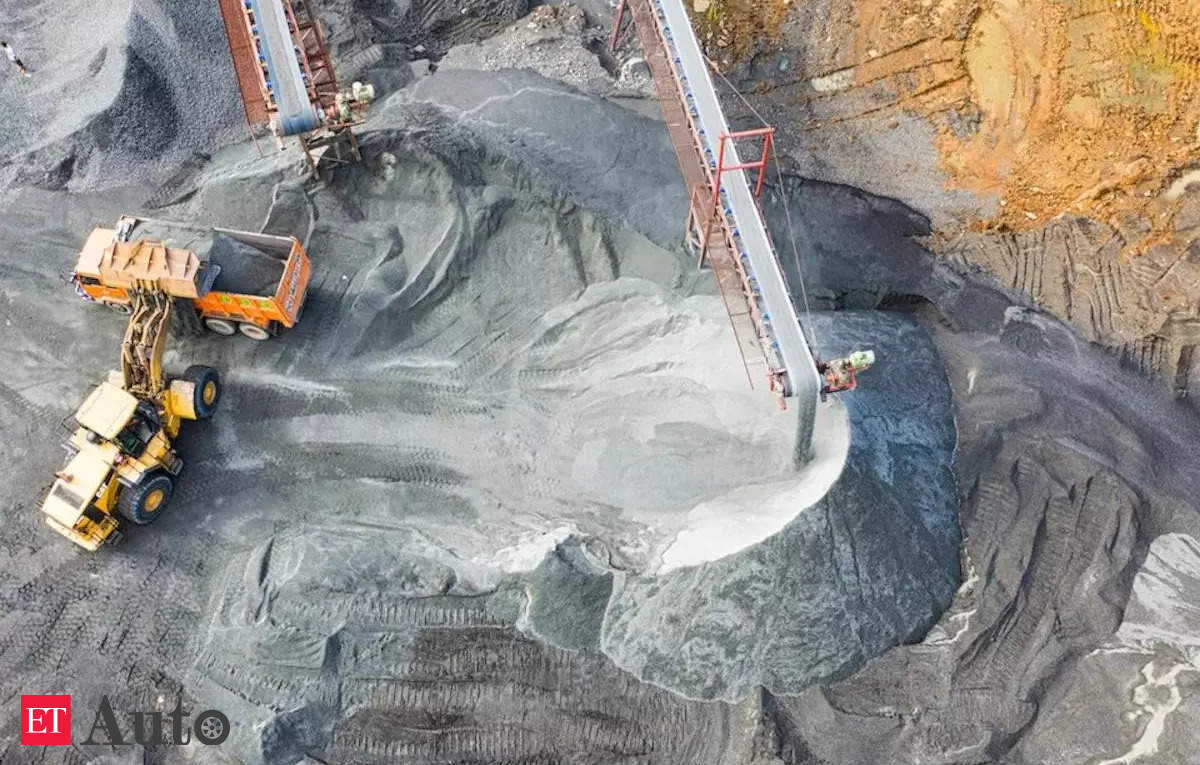

Its explosives business helped offset that, bolstered by rising exploration budgets and activities, particularly in green and battery minerals, Omnia said.

The global shift away from polluting fuel sources such as coal has increased demand for cleaner energy minerals such as lithium, cobalt, graphite and copper, leading to more exploration projects.

Omnia declared a special dividend of 3.25 rand per share, in addition to an ordinary payout of 3.75 rand per share, returning 1.16 billion rand to its shareholders.

“For the first time, we have equal profit from agriculture and mining, because we have always been known as an agriculture business,” Omnia CEO Seelan Gobalsamy told Reuters in an interview.

“What you see is the diversification benefit of the global earnings coming through from our mining business. It means our shareholders have a different, progressive asset that is diversified,” he added.

Omnia’s explosives unit BME operates in 17 African countries including South Africa, Zimbabwe, Zambia, Mali and the Democratic Republic of Congo. It also has partnerships in Australia and Indonesia, markets which Gobalsamy said were growing rapidly.