30 June 2025

Residual value (RV) pressure, emerging Chinese brands, growing profitability and the importance of battery-electric vehicle (BEV) sales. Autovista24 journalist Tom Hooker analyses how and why the landscape of used-vehicle retail is changing.

Industry associations, automotive experts, and carmaker representatives gathered in Frankfurt for the Used Vehicle Retail Summit. The event covered various used-car market topics, including current RV trends, building consumer trust and the sale of BEVs.

Europe’s residual value development

EV Volumes director of content, Christian Schneider, explained how RVs have changed in Europe over the last few years. ‘During the pandemic, because of all the supply shortages, a lot of people were happy that RVs were growing through the roof,’ he explained.

‘But over the last two years, we have seen that across all fuel types, across most countries in Europe, RVs are dropping. They are coming back slightly to a pre-pandemic level, but we still see RVs across various parts of Europe that are above pre-pandemic levels.

‘We see supply and demand balancing a little bit more at the moment. We also see that there is a lot of economic pressure and economies are struggling. So, of course, that has an impact on RVs. For 2025 and 2026, we do not expect the pressure on RVs to get better,’ stated Schneider.

Increased prices

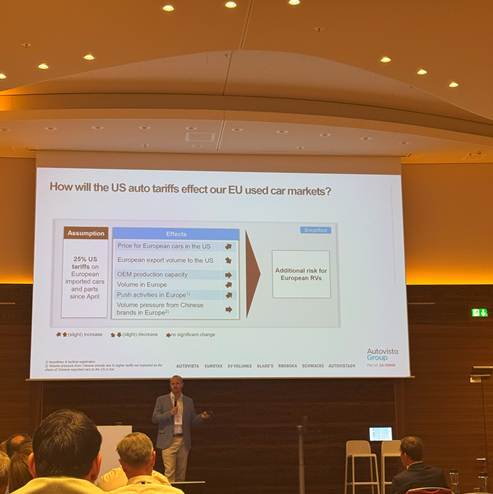

He also noted the impact US tariffs could have on the European used-car market. ‘What we are expecting, if the 25% automotive tariffs stay in place after July, is that the prices for European cars in the US will grow. That also will mean that European export volume to the US will shrink.’

‘But for OEMs, they are producing cars, and they must be sold somewhere. So that means in Europe, you will see increasing volume in our European brands over the next months and maybe even years. This is not a big thing for electric vehicles (EVs), because electrification in the US is not advanced.’

He highlighted that the bigger impact will be on internal-combustion engine (ICE) vehicles. Overall, if higher US tariffs remain after July, there will be additional risk to RVs. EV Volumes is also observing an increasing number of used BEV sales. However, RVs are dropping at an even steeper rate than the overall market.

This is because more BEVs are entering the market than before. However, most of this volume is not coming from private buyers. Instead, it is being pushed through fleet channels.

Furthermore, a lot of the incentives offered in European countries are only offered on the new-car market. These factors are generating an artificial oversupply for used-car markets.

China’s growing influence

Chinese BEV volumes are forecast to continue to grow in Europe over the next few years. Carmakers from China held a 7% share of the European new-car market in 2024. EV Volumes expects this to grow to 10% this year.

Despite this, RVs of these models still trail behind BEVs originating from other regions. ‘In Germany, Chinese brands are performing nine percentage points (pp) lower than those from established Asian, European or US brands,’ highlighted Schneider.

‘But we saw over time that this is getting smaller. Around one year ago, there was approximately a 14pp or 15pp difference between the brands. So, they are closing the gap, but we still see that the brand reputation takes significant time to fill up, especially for used-car buyers.’

In Spain, this gap is smaller, as the country’s domestic brands are not as strong compared to those in Germany.

Used-car retail

With overall BEV RVs struggling compared to other powertrains, and an increasing number of all-electric models entering the used-car market, how can dealerships survive?

As AECDR secretary general Friedrich Trosse explained, a more effective dealership and communication strategy is needed to keep used-car buyers engaged.

‘The used-car market is going to be the low-income segment of BEVs, because we are never going to have something like a Volkswagen Beetle ever again that is affordable and has modern technology,’ he commented.

For retailers, planning their overall used-car market strategy is also becoming more important, especially when compared to their new-car business.

‘I think that used cars, for retailers and dealers, are an amazing opportunity. In some mature markets, the used-car business is double the size of the new-car business,’ outlined CARA board chairman Luis-Maria Perez-Serano.

‘You can achieve more money and higher margins. Many retailers are now earning more money from used cars than new cars. What is maybe even more important is that used cars are essential for customer retention. They play a major role as the first entry point for buyers,’ he said.

However, Serano added that the used-car market is a complex business. Having a good digital interface is essential for dealers, and he believes more can be done to make the customer’s digital journey easier. This includes showing EV battery health checks online.

Serano also discussed cross-border sales in Europe, and that despite the EU being considered as a single economic market, this is not yet the case for the used-car market. However, improving the facilitation of these sales could create opportunities for retailers who could maximise revenue by moving vehicles to other countries.

Additionally, he stated that there is still a lot to do in terms of educating and training staff in used-car sales and remarketing.

Missed opportunities in retail

‘I still see a lot of missed opportunities in every country. I know most markets have evolved into a more balanced ratio between using new and used cars, but the profitability has not been in the new cars as it has been over the past years,’ explained vice president and chairman of CECRA, Rodrigo Ferreira da Silva.

He also highlighted the importance of the customer having access to accurate in-vehicle data. He advocated for the implementation of a car pass at a European level.

This is a vehicle diagnostic report that provides a certificate to buyers at the time of sale, verifying the vehicle’s mileage accuracy. It has been designed to fight against odometer tampering in the used car market. However, the service is currently only offered in Belgium and the Netherlands.