24 September 2025

Currently, one of the major talking points in Europe’s automotive market is the entrance and expansion of Chinese companies. Autovista24 journalist Tom Hooker explores their plans and strategies in the region.

A total of 116 exhibitors at this year’s IAA Mobility in Munich came from China. This was up from 70 in 2023, which in turn was more than double the figure in 2021. Chinese companies at the event ranged from high-volume car brands, battery producers, luxury marques and intelligent mobility solution providers.

Cars made in China accounted for 6% of sales in the EU in the first half of the year. This was up from 5% in the first half of 2024, according to ACEA. Some of this share is the result of European brands manufacturing in the country, such as Cupra. However, China’s automotive expansion into Europe is undeniable.

Marques including BYD, Xpeng and Hongqi have recently announced production plans, research centres or regional hubs in Europe. So, how are these companies entering the continent? What are the main challenges? Additionally, how important are events like IAA Mobility in increasing consumer awareness?

High-volume Chinese brand

Between January and July, Xpeng sold 234,374 electric vehicles (EVs) across the world, according to data from EV Volumes. While the majority were delivered in China, 4.2% were sold in Europe. Autovista24 asked Xpeng G9 product manager Chloe Ding how the brand plans to increase its sales in the region.

‘Of course, every company wants to give a very big sales volume in the European market, that is no doubt. For our products, we actually said, we are more concerned about how we choose to satisfy our users, because if we cannot satisfy them, we cannot be eager for big sales,’ Ding explained. ‘Sales is just a number target. Our target is in the product itself and how to make it better.’

She highlighted how Xpeng can learn something from Kia and Hyundai. The two non-European brands have created a foothold in the market. Ding then acknowledged how over-the-air updates and aftersales services are vital to customer satisfaction and trust.

Dealer network importance

‘We have a plan for how to make our network in Europe bigger. There is no doubt that we would ask for more dealers to join our network,’ Ding outlined.

‘Also, we would provide aftersales services. We want to hear from our users, what they say we can improve, and what help they need. Most of our product details come from when we hear from our users.’

Christoph Ruhland, director of business development at Autovista Group, recently highlighted the differences in consumer habits between Europe and China. In Cracking the code: Chinese EV brands entering Europe, he recognised the importance of establishing a dealership network.

‘A few brands started with flagship stores, big stores in major European cities. This approach does not work in Europe; it works in China.’ With longer working weeks in China, consumers are more likely to buy a car in a mall on a day off.

‘Europeans, they want to buy cars at dealers. It is also important to have a strong dealer network for aftersales. So do not only think about sales, also think about aftersales,’ he added.

Chinese brands’ market positioning

One major challenge for Chinese brands entering Europe is deciding how to position themselves. Some carmakers may focus on their cost-to-quality ratio, technology features, or luxury status. So, where does Xpeng sit?

‘We cannot have the same level of luxury brands like Audi and BMW. So, this car may be focused on the mass or mainstream market. But we believe that one day we will have many more customers, and our reputation will be established. So, one day we may have cars which will be seen as luxury,’ Xpeng P7+ product manager Eva Han told Autovista24.

Attracting more customers can be achieved by appealing to different demographics and, in turn, different vehicle segments.

‘We have a rich car line for the Xpeng brand. In China, we have three different platforms, which run from high to low. Because the European market is one of the biggest markets worldwide, we will add more and more cars,’ commented Han.

‘The P7+ will be launched on the European markets in February 2026. This car only offers a two-wheel drive for the Chinese market. But, for the European market, we will add four-wheel drive,’ she stated.

Chinese supplier growth

Understanding the differences between Chinese and European consumer preferences is not only vital for carmakers but also for automotive suppliers and mobility solution providers. One such company is Desay SV.

The company presented many of its products at IAA Mobility. This included an AI-powered intelligent cabin platform, display solutions and full-stack advanced driver-assistance systems (ADAS) technologies.

‘I think the average age of users of vehicles in China is younger than in Europe. So, I think the Chinese consumers are more used to the smartphone-like digitalisation, and the digitalised features of the vehicles,’ head of Desay SV Europe Yang Yong told Autovista24.

‘European customers’ demands are, to my understanding, more diversified, because of a longer automotive culture and history, and the long-lasting culture of horsepower, engine performance, braking and suspension.’

‘So, I guess these are still more important to the European customers. But I believe digitalisation and intelligence will still be welcomed,’ Yong noted.

These differences can mean that products are adapted for different regions. For example, in China, settings and vehicle information are largely accessed on the display. But Yong highlighted that users still want to have some mechanical buttons in Europe.

Localising production

The company recently celebrated the structural completion of its factory in Spain, joining other Chinese companies which have built foundations in Europe.

‘I think the requirement for localised production started from the COVID-19 period. Every OEM was talking about supply chain security, to make sure that if something happens in some regions, you will continue production in other regions,’ said Yong

‘For us, it is very important to show the customer and the people that we are very committed here, we are not a short-term business. We really want to be part of the industry and the ecosystem that we want to develop together,’ he added.

The ‘China speed’ advantage

One of the biggest advantages that Chinese companies can use to aid their European growth is fast development speeds. During Autovista Group’s recent webinar, Ruhland compared the BEV development speed in different regions, when the platform is already completed.

‘Europeans and Japanese need the longest, between 42 and 60 months. The US can do it a bit quicker, and Koreans can do it within three or four years. But Chinese OEMs can do it between 18 and 24 months. 18 months is now more or less the average,’ he said.

Yong also highlighted this development speed when talking about Desay SV’s cabin display solutions.

‘I think everybody right now is talking about the so-called China speed, right? In this market, we have to cater to the ever-evolving requests from users and customers. We have to implement all these new requirements the quickest, with the best quality and cost, so that we can meet the requirements of the customers,’ he outlined.

Can Chinese brands become memorable?

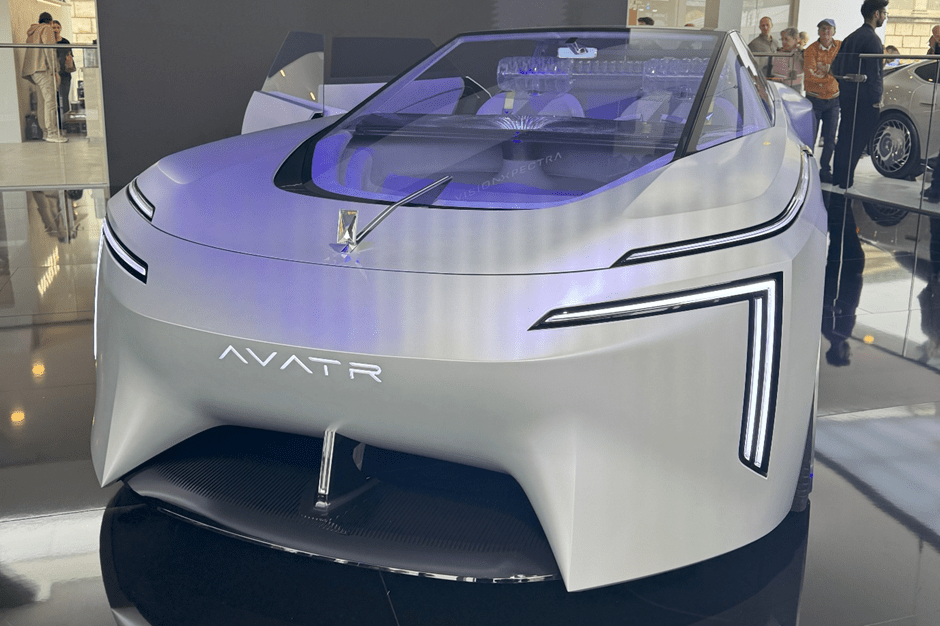

One hurdle Chinese carmakers face is building a memorable brand. However, many marques are entering Europe using number-based naming conventions. This includes Avatr, a premium EV brand owned by Chinese OEM Changan. So, can they still stand out?

‘It is a tricky question. It can polarise opinion. In my opinion, Avatr is the brand, and it should be the bigger name and needs to be remembered,’ Avatr advanced senior exterior designer Pedro Ruperto Mallosto das Chagas told Autovista24 at IAA Mobility.

‘All the cars are part of a family that needs to be consistent. The numbers are more like a quote to define the Avatr products in the range. So, the brand is more important than each specific car,’ he stated.

Ruhland highlighted that unique selling points (USPs) can be a vital factor in building brand awareness.

‘Every Chinese OEM that wants to be successful in Europe needs to answer the question “why should a European car buyer that can already pick among 40 existing European brands, why should they buy a Chinese car?” If this European car buyer goes for a Chinese car, why then should they pick your brand?’ he asked.

‘The brand needs to have a core USP that is easy to remember and easy to communicate. I always recommend looking at how Hyundai and Kia did it 20 years ago when they started their very successful journey in Europe.

‘They came up with very long warranties,’ Ruhland said. ‘This could be a strong USP for a Chinese brand. Imagine a Chinese brand would say “our cars have a 10-year warranty, including battery.”’

‘This would be a very strong message. This would boost residual values, and could really help create awareness,’ he commented.

Designed to stand out

One way to create a USP is through design. With a strong and consistent design language, customers can easily recognise a brand and its models.

‘I think colour, material and finish (CMF) design is the big difference compared to other Chinese brands. We really lead the design with CMF; it is not just applied afterwards. When you look at the car, you can easily remember the design and intention,’ Avatr senior CMF designer Maud Balmisse told Autovista24.

Chagas added that through the front fascia and light signature present on Avatr models, they are recognisable in China. The latter can be used as a clear way to distinguish your brand from others.

‘Light signatures are increasingly recognised or used in some respects. They are perhaps the most easily identifiable singular thing, but I would not say that they are necessarily the most important,’ Car Design Research director Sam Livingstone told Autovista24.