Shares of Happy Forgings listed on the exchanges at a premium of 18% on Wednesday. The stock listed at INR 1001.2 on BSE, up 17.8% against the issue price of INR 850. On NSE, it debuted 17.6% higher at INR 1000.

Ahead of the listing, the company’s shares fetched a premium of INR 282 in the unlisted market.

The issue received a strong subscription of 82 times at close.

The massive subscription of the IPO was driven by institutional investors. The categories reserved for retail investors and NIIs were subscribed 15 times and 62 times, respectively. The QIB portion has been booked 220 times.

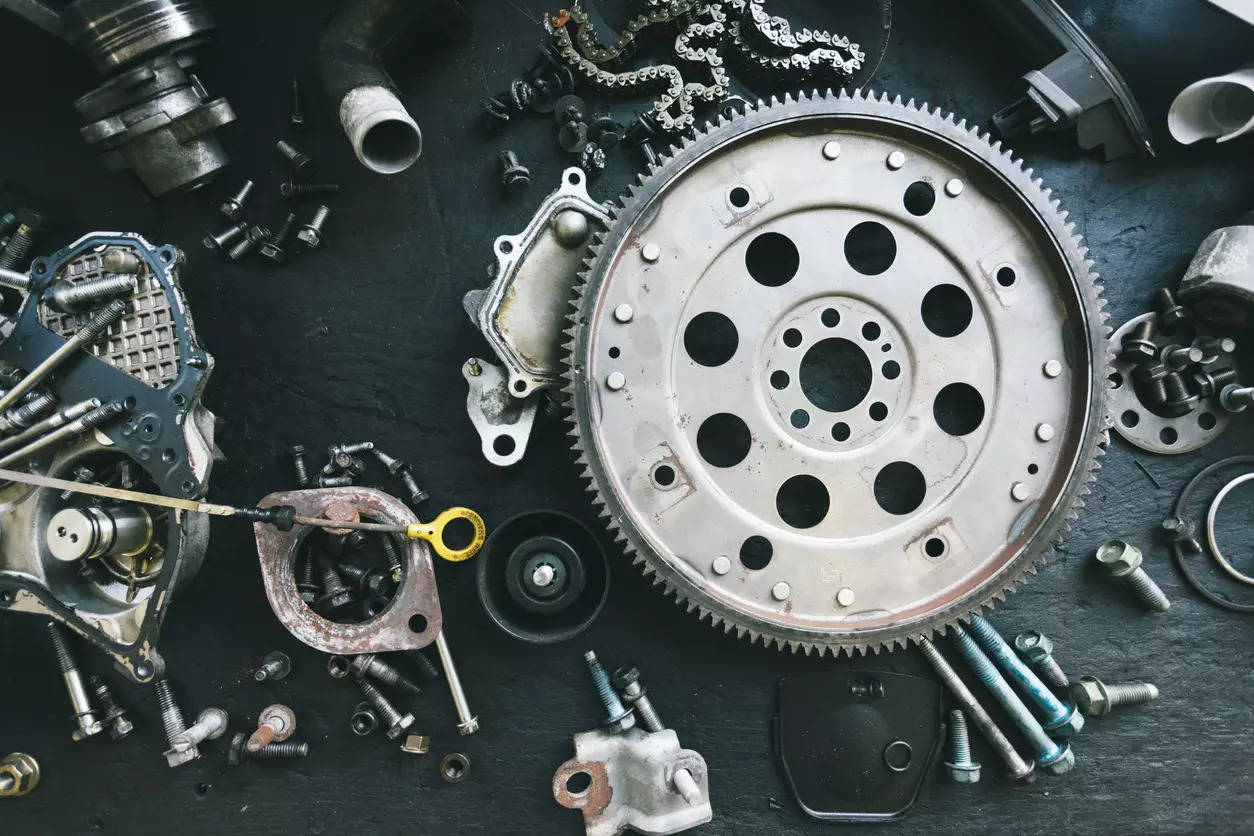

Happy Forgings is an engineering-led manufacturer of safety critical, heavy forged and high precision machined components.

The company caters to domestic and global original equipment manufacturers, manufacturing commercial vehicles in the automotive sector, while in the non-automotive sector, its clients are manufacturers of farm equipment, off-highway vehicles and manufacturers of industrial equipment and machinery for oil and gas, power generation, railways and wind turbine industries.

It makes a wide range of forged and machined products such as crankshafts, front axle beams, steering knuckles, differential cases, transmission parts, planetary carriers, suspension brackets and valve bodies across industries for a diversified base of customers.

Net proceeds are proposed to be utilised for the purchase of equipment, plant and machinery, prepayment of debt and other general corporate purposes.

For the six months ended September 2023, the company clocked revenues of INR 600 crore, while profit stood at INR 116 crore. In FY23, revenues rose 39% to INR 1196 crore and profit jumped 47% to INR 209 crore.

During FY21-23, its revenue, EBITDA and PAT clocked a CAGR of 43%, 47% and 55%, respectively. Meanwhile, RoCE improved from 14% in FY21 to 22% in FY23.

JM Financial, Axis Capital, Motilal Oswal Investment Advisors, and Equirus Capital acted as the book-running lead managers to the issue.