[ad_1]

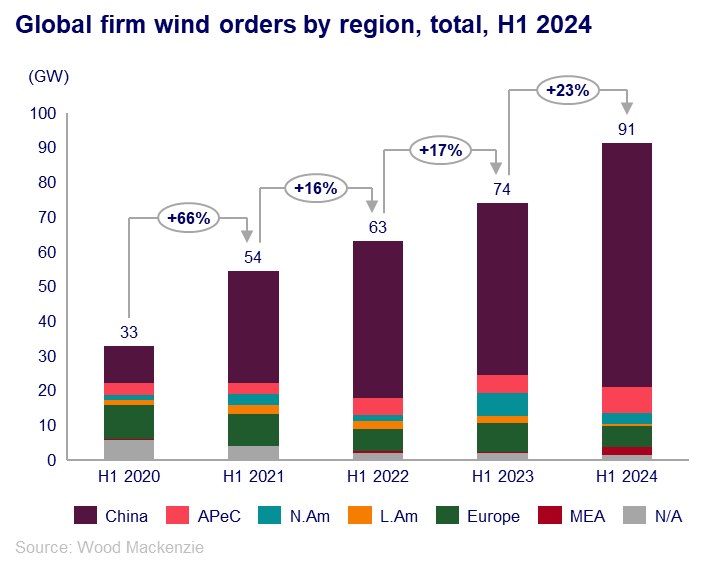

Global wind turbine order intake reached new highs in H1 2024, with 91.2 gigawatts (GW) of activity, a 23% increase year-over-year, thanks to the Asia-Pacific region.

Globally, investment by wind energy developers in H1 2024 totaled $42 billion, a 3% increase year-over-year, according to new analysis from Wood Mackenzie. Much of that activity occurred in Q2, which saw 66 GW of wind turbine order intake, due in large part to demand in China’s northern region.

In fact, the Asia-Pacific region accounted for a whopping 85% of global intake in the first half of 2024. China saw 70 GW of orders for its domestic market and captured 5 GW of wind turbine orders abroad. Developers in India made great strides in the first half as well, yielding a 69% increase year-over-year.

India’s Envision was the leader for overall order intake, followed by China’s Windey and Goldwind, all with more than 12 GW of activity.

However, Western wind turbine OEMs struggled due to intensifying competition over more modest demand and contributed just 13% of global order intake in H1. In total, order intake outside of China decreased 16% (-2.3 GW) in the first half. Intake in the Americas and Europe dropped 42% year-over-year, with less than 10 GW combined ordered in H1.

“Chinese OEMs continue to break records for order intake on activity both domestically and aboard,” said Luke Lewandowski, vice president, global renewables research at Wood Mackenzie.

“Conversely, western OEMs are struggling to keep pace, challenged by China’s competitive advantages in pricing and availability. Soft demand in Western markets as well as policy uncertainty, inflation, and other cost pressures have also driven down activity in the US and Europe. China remains the undisputed leader in the industry.”

While global onshore order activity increased in the first half, the offshore sector struggled, with order intake decreasing 38% year-over-year through the first half (-4.1 GW) as challenging project economics have curbed the market.

“The offshore market has almost 30 GW of conditional orders globally, 21 GW of which are for projects in Europe and the US, but challenging economics continue to delay conversion into firm orders,” said Lewandowski.

Read more: Renewables now make up 30% of US power capacity – FERC

To limit power outages and make your home more resilient, consider going solar with a battery storage system. In order to find a trusted, reliable solar installer near you that offers competitive pricing, check out EnergySage, a free service that makes it easy for you to go solar. They have hundreds of pre-vetted solar installers competing for your business, ensuring you get high-quality solutions and save 20-30% compared to going it alone. Plus, it’s free to use and you won’t get sales calls until you select an installer and you share your phone number with them.

Your personalized solar quotes are easy to compare online and you’ll get access to unbiased Energy Advisers to help you every step of the way. Get started here. –trusted affiliate link*

FTC: We use income earning auto affiliate links. More.

[ad_2]