In the past week, TSLA stock has increased by about one-third of its previous value. But this increase has had nothing to do with company performance, or even due to external factors like consumer tastes or beneficial changes in EV policy. Rather, the speculation has come out of a simple desire to see Tesla become the benefit of government corruption.

Government corruption is a problem in much of the world. Where there is power, there will be some who seek to abuse it.

To be clear, while the word corruption gets tossed around a lot, it does still mean something. It happens when a person in some position of authority uses that authority to channel wealth not towards the general public good, but to either themselves or to friends of theirs.

Advanced democracies like those in Europe and the US portray themselves as being beyond corruption, and in many ways the most obvious, base levels of corruption – like direct bribery of officers of the law – are not a common a occurrence in the cultures of these advanced democracies.

But this does not mean there is no corruption in these societies, it’s just revealed in different ways, or hidden behind certain levels of gentility and tradition. Nations that score high on absence of corruption indices may have rid themselves of certain forms of direct bribery, but when Toyota speaks, Japan listens; or when new US exhaust rules are up for debate and polluters like Big Oil and Auto ask for more pollution, those exhaust rules get softened despite opposition from doctors, nurses, scientists, public interest groups, many businesses, and the general public.

And then, of course, there are the various court-blessed forms of bribery and election tampering which, well, we’re going to see a couple examples of in a few moments.

Though perhaps those customs of gentility are showing some cracks these days, as the US stock market has openly been rewarding Tesla’s stock price all week (until today, its first down day in a week), not due to any changes in company performance or even any beneficial changes in policy (in fact, prospective policy changes are likely damaging to Tesla’s mission and product categories, not helpful), but rather due to the stock market’s seemingly open desire to see Tesla benefit from direct government corruption.

Trump’s history of corruption

The market does have reason to think this, too. Convicted felon Donald Trump, the next man who will squat in the White House after finally winning more votes than his opponent on his third try (and after committing treason in 2021, for which there is one clear Constitutional remedy), has displayed open corruption at many points in the past.

This legacy of corruption is well-chronicled and easily seen by anyone who has paid any attention. That said, the scope of it, with over 3,700 conflicts of interest displayed during his first stint as pretender to the throne, might still surprise even those who have closely followed the ridiculousness of the man’s existence.

Musk buddies up with anti-EV Trump

Nevertheless, the CEO of the nation’s largest EV maker has attempted to pair up with the felon in question, pledging hundreds of millions of dollars he got from selling EVs to fund a candidate who promised to tank EVs if oil companies gave him a billion-dollar bribe.

Musk, despite previously correctly acknowledging that “Climate change is real. Leaving [the Paris Agreement] is not good for America or the world,” has forgotten anything he might have known about climate change, and has buddied up to someone whose last occupation of the White House, and whose party’s recent actions, have been marked by several moves aimed towards poisoning Americans with more air and water pollution and saddling everyone with higher health and fuel costs.

In addition Mr. Trump has shown total ignorance (well there’s a phrase you surely haven’t heard in the last microsecond) of everything related to EVs and EV-related policy, and his running-mate even wrote a bill to increase EV prices by $15,000 compared to polluting gas vehicles.

Further, those in his orbit have indicated they want other changes that likely conflict with Tesla’s business model – for example, the first car dealer elected to the Senate wants to change car dealership rules, probably not in the benefit of Tesla, which has aligned itself directly against the car dealership model.

This, at first glance, seems incongruous (also at the second glance. and several more after.) It’s strange that the stock market would react to a vote of confidence in a confidence-man who clearly intends to be bad for EVs… by rewarding a company whose stated mission is to accelerate the adoption of EVs.

Stock market rewards TSLA for corruption, not performance

But wait! There is perhaps an explanation for this, and if you’ve been paying any amount of attention at all (a luxury which 74 million Americans seem incapable of), I bet you know what it is.

It’s corruption!

Indeed, the stock market has decided that the recent situationship between these two individuals – who both have such a void in their hearts that they’ve wasted billions of dollars of their (and other people’s) money on social media companies in order to feel loved – is somehow real and is going to flourish into a beautiful, corruption-laden baby in the form of Tesla somehow being uniquely advantaged by a close relationship with the federal government.

What we’re talking about here is a public consensus that Tesla, the company whose market cap has spiked more than any other over the course of the past week, is going to uniquely benefit from corruption. That it will gain due to the personal relationship described above. That’s why TSLA went up so much in the past week.

It’s not because the Cybercab is driving on well-mapped private roads like we already knew it can. It’s not because they’re having trouble selling Cybertrucks. It’s not because Tesla’s Mexican factory plans have been thrown into question. And it’s not because they’ll get 50 cents or whatever every time a Volvo charges at a Supercharger.

It’s because TSLA buyers, in a country that has publicly prided itself on being a bastion of economic freedom, and from a party and campaign that has claimed for so long to support these ideals, think Mr. Trump and the republicans will do some good ol’ big-government corruption and they want to benefit from it. Some analysts have attempted to come up with any number of other urbane explanations to hide their cheerleading for this corruption, but Occam’s razor leads us to the obvious answer as to what’s happening here.

What kind of corruption does the market anticipate?

We don’t actually know what sort of corruption could occur here to benefit Tesla, or what the market is anticipating. As mentioned above, the likely policy changes would all be bad for EVs and solar, which are the only two businesses Tesla has ever made money in.

Already today, a new EPA pick has been announced who has already signaled an intent to destroy the environmental and economic progress made under the current EPA. He has repeatedly attacked clean air over his legislative history.

Some have theorized that a new government would end various legal actions against Tesla, and that this would benefit the company.

However, the most significant legal actions against Tesla are not on the federal level, and are state-level actions or class actions, not ones led by the government. The federal government is currently undergoing no significant legal actions against Tesla, except typical safety-related NHTSA investigations which every automaker sees, and aren’t likely to result in sweeping changes for Tesla.

And even if the White House did try to illegally intervene in non-federal actions (and, when you vote for a criminal, you can indeed expect him to do crime) – like the case over Musk’s illegal pay package – this specific one would help Tesla by saving the company from wasting $55 billion on a bad CEO.

Even TSLA cheerleader Adam Jonas noted the “difficulty” in understanding how this potential closeness would benefit Tesla, in a note sent out yesterday.

So, again, it is not clear what sort of corruption TSLA gamblers think the company would benefit from. But the message from the stock market is clear: that’s what it wants.

Democratic policy benefits Tesla greatly

All of this comes against a backdrop of the last 4 years of government policy that has benefitted Tesla greatly. Tesla originally started business in a heavily Democratic state, with support from that state’s regulations aimed towards putting zero emission vehicles on the road.

The company applied for and earned early loans from President Obama’s Democratic federal government which helped it get started, and benefitted from Obama’s EPA finally harmonizing regulations with California, a smoother regulatory environment which Mr. Trump later torpedoed. It also received more benefit from the first round of federal tax credits than any other company.

And the Biden-Harris administration has again greatly benefitted Tesla, by improving the federal tax credit which Tesla has again used more than any other automaker. The EPA has made a number of positive actions in the last four years, which Tesla has lobbied for, and which Tesla will benefit from (in contrast to Mr. Trump’s actions, which Tesla lobbied against, and which harmed Tesla).

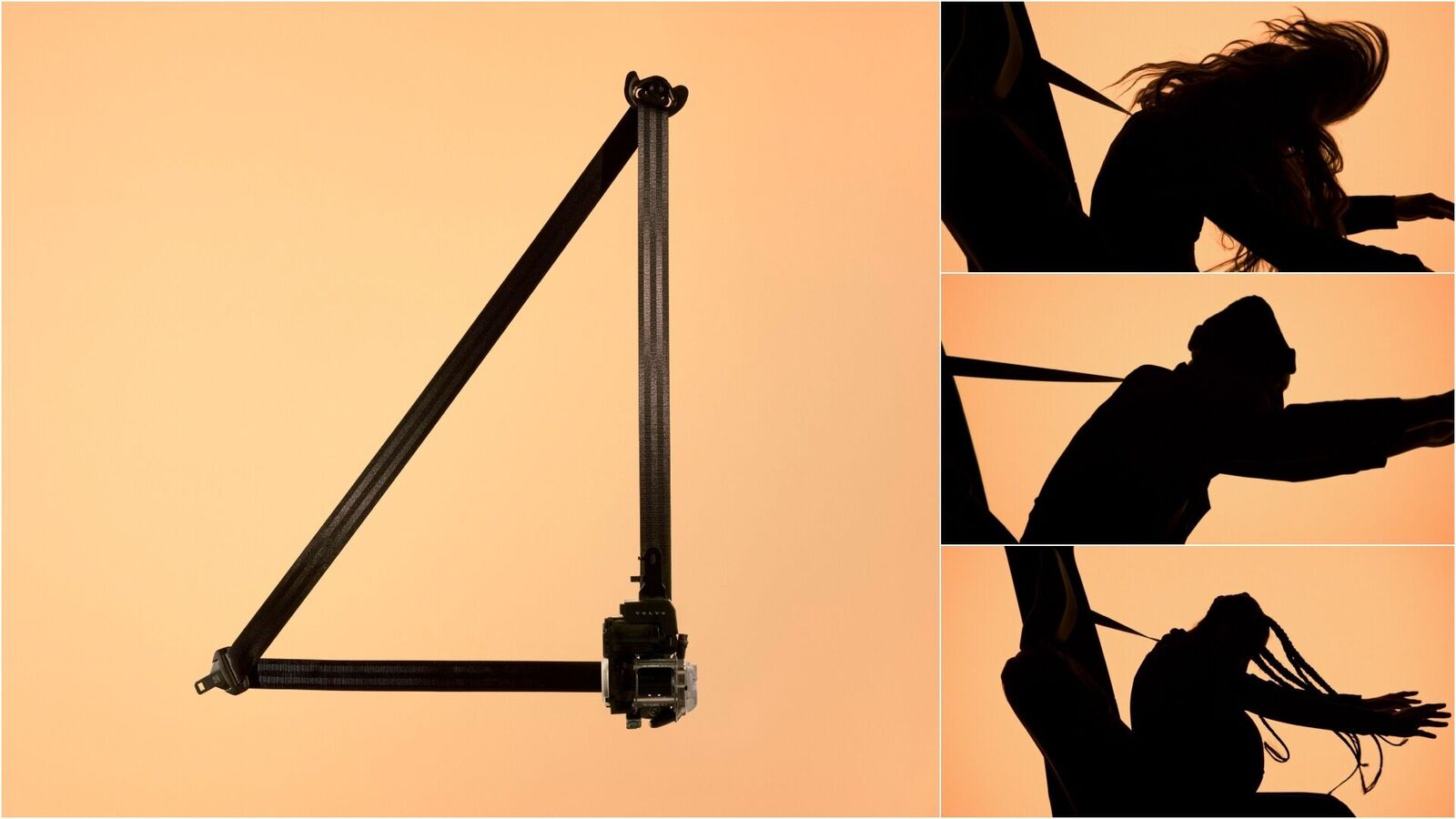

Even the NACS transition was sparked by Biden, because federal rules requiring intercompatibility as a qualification for receiving charging grants is what led Tesla to introduce the standard to begin with. The company will likely benefit from this, though recent chaos caused by the mercurial actions of its bad CEO have put a damper on that.

Unlike investors’ apparent desires from the incoming regime, these actions were not corruptly targeted towards an individual company on the basis of personal gain or perceived friendship, but towards the public good. Tesla just happened to be the biggest company building a product that helps make transportation cleaner, and thus benefitted the most.

So again, the whiplash here of a positive stock response to negative news is confusing, unless we explain it as corruption.

Will it work?

Now, there are still reasons to think that this might not turn out as well as this week’s gamblers might think.

After all, both individuals are known for their capriciousness, for turnover increasing the closer you get to them in their respective organizations, for those they’ve worked closely with speaking out against them, and for their habit of firing high-performers who deign to present ideas – no matter how reasonable – if those ideas happen to be in opposition to whatever each respective egomaniac’s current fixation is.

Always a sign of a great leader if their closest team members keep quitting – and surely two “leaders” of that sort are even more likely to work well together… right?

But whether it works out or not, let us call all of this exactly what it is: the stock market is actively, openly, betting on corruption (and not just with Tesla – this week, crypto markets have been going crazy, expecting that having a scammer in the White House will benefit an asset class that exists solely to facilitate scams). It hopes for a handout, hopes for exemptions and carveouts, and hopes for “government to pick the winners and losers” (remember when the republican candidate made that statement, about Tesla specifically?).

This is not a group of people that support properly working markets, competition, or any of the ideals they often profess. They are instead expecting and advocating for corruption. It’s the kind of thing that’s more appropriate for a Banana Republic(an), not one of those aforementioned advanced democracies which we used to be able to consider ourselves one of.

Charge your electric vehicle at home using rooftop solar panels. Find a reliable and competitively priced solar installer near you on EnergySage, for free. They have pre-vetted installers competing for your business, ensuring high-quality solutions and 20-30% savings. It’s free, with no sales calls until you choose an installer. Compare personalized solar quotes online and receive guidance from unbiased Energy Advisers. Get started here. – ad*

FTC: We use income earning auto affiliate links. More.