The German Engine Stalls: A 2025 Industry Crisis Report

The German automotive industry, long the engine of Europe’s largest economy, is facing its most severe crisis since World War II. As of late 2025, a “perfect storm” of high energy costs, technological stagnation, and fierce Chinese competition has forced Germany’s industrial giants to do the unthinkable: close factories and slash tens of thousands of jobs.

Here is a detailed breakdown of the crisis, the numbers, and what it means for the future of the “Made in Germany” brand.

The “perfect storm”: Why is this happening now?

The crisis isn’t the result of a single failure but a convergence of structural problems that have been building for years:

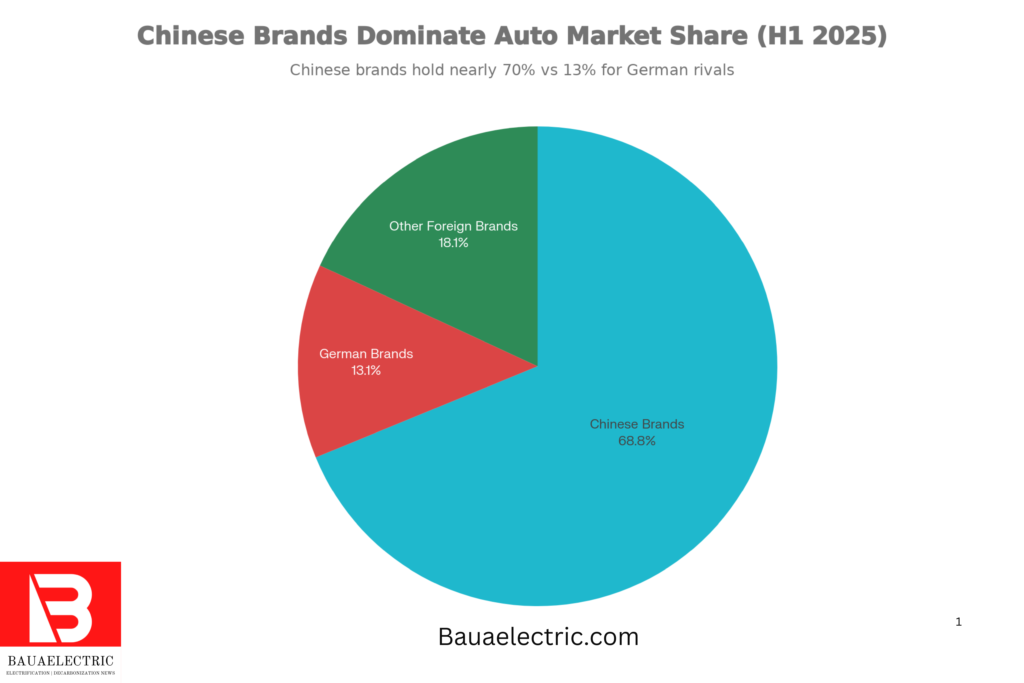

- The China Shock: For decades, China was a goldmine for German automakers. Now, it is their biggest threat. Chinese consumers have shifted decisively to domestic brands like BYD and Xiaomi, which offer superior digital features and battery technology at a fraction of the price. German market share in China has plummeted from 25% to roughly 15% in just five years.

- Technological Lag: German engineering excellence (mechanical precision) is less relevant in the EV era, where software and battery chemistry define value. German automakers have struggled with “software glitches” and delayed platform rollouts, while competitors like Tesla and Chinese OEMs iterate rapidly.

- Energy & Operating Costs: Following the loss of cheap Russian gas, German industrial energy prices remain uncompetitively high. Combined with Germany’s high labor costs, this has made domestic production increasingly unviable compared to Eastern Europe, Mexico, or China.

- Bureaucracy & Recession: Germany is entering its third consecutive year of recession in 2025. Industrial output is falling, and bureaucratic hurdles stifle the speed of innovation needed to catch up.

Introduction: The “Detroit Moment”

For decades, “Made in Germany” was the gold standard of automotive excellence. It stood for precision, reliability, and engineering dominance. But as we close 2025, the German automotive industry is facing a crisis of existential proportions.

A “perfect storm” of high energy costs, technological stagnation, and ruthless competition from China has forced the unthinkable: mass factory closures and layoffs in the heart of Europe. This isn’t just a dip in the cycle; it is a structural collapse that some analysts are calling Germany’s “Detroit Moment.”

In this deep dive, we break down the numbers, the reasons, and what this means for the global electric vehicle market.

The Body Count: Major Layoffs & Restructuring

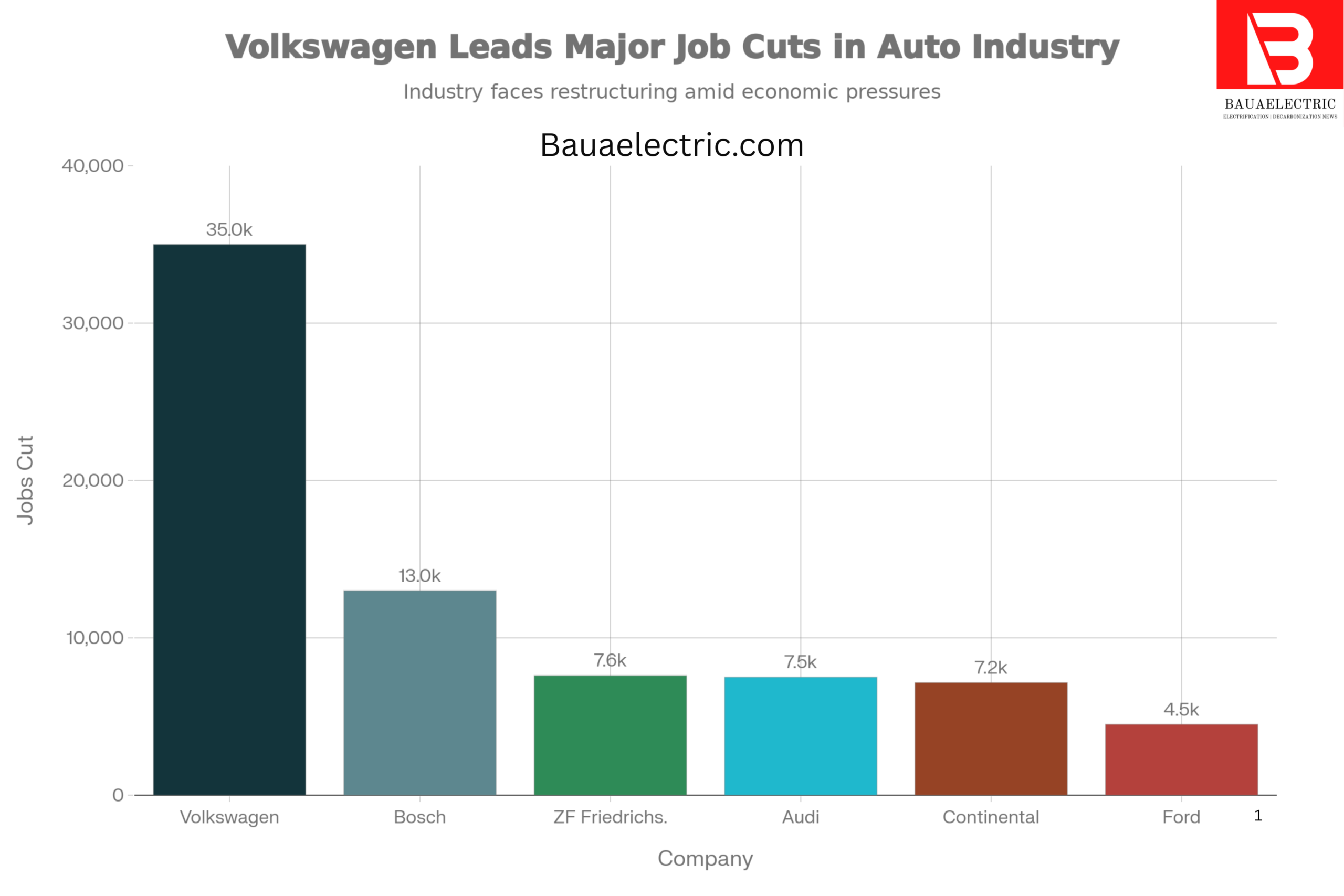

The most visible sign of the crisis is the wave of job cuts sweeping through the industry. In the first half of 2025 alone, the sector shed over 51,500 jobs.

1. Volkswagen: The Historic Shakeup

- The Cuts: VW plans to cut 35,000 jobs in Germany by 2030.

- The Factories: For the first time in its 87-year history, VW threatened to close domestic plants. A last-minute deal with the union (IG Metall) in December 2024 averted immediate closures but came at the cost of a massive capacity reduction of ~700,000 units.

- The Strategy: A shift away from volume to value, but the brand is struggling to find its footing in the affordable EV segment.

2. Mercedes-Benz: The “Shock” Cuts

- The Numbers: Reports in late 2025 indicate plans to cut up to 16,600 jobs worldwide (approx. 10% of its workforce).

- The Goal: A “Next Level” austerity program aiming to save €5 billion. While job security in Germany was extended to 2034, voluntary redundancies are being pushed aggressively to slim down administrative and non-production roles.

3. The Supplier Bloodbath (ZF, Bosch, Continental)

Suppliers are often hit harder than the automakers themselves as orders dry up.

- ZF Friedrichshafen: Cutting 7,600 jobs in its electric powertrain division alone by 2030—effectively 25% of that unit. Total cuts could reach 14,000 this decade.

- Bosch: Slashing 1,100 jobs at its Reutlingen plant and thousands more globally as it pivots from combustion engine parts to software and semiconductors.

- Continental: reducing its global workforce by 7,150.

- Audi: Cutting 7,500 jobs in Germany by 2029, primarily in development and administration.

4. The Great Bloodletting: Layoffs by the Numbers

The most visible scar of this crisis is the wave of job cuts sweeping across the sector. In 2025 alone, the German auto industry shed over 55,000 jobs.

This isn’t limited to one struggling brand; it is a systemic purge affecting OEMs and suppliers alike.

Major German Automotive Job Cuts Announced or Executed (2024-2025)

Key Restructuring Updates (December 2025):

- Volkswagen: In a historic blow to its workforce, VW confirmed plans to cut 35,000 jobs by 2030. While a last-minute deal with the IG Metall union prevented immediate factory closures this winter, production capacity is being slashed by ~700,000 units to align with shrinking demand.

- Ford Saarlouis: The end of an era. Production of the Ford Focus officially ended on November 21, 2025. The plant, which once employed 4,500 people, has ceased vehicle production entirely, leaving thousands to seek retraining or transfer.

- The Supplier Crisis (ZF & Bosch): Often the canary in the coal mine, suppliers are hitting the brakes hardest.

- ZF Friedrichshafen is cutting 7,600 jobs specifically in its electric powertrain division—a shocking admission that EV parts orders are far below expectations.

- Bosch is reducing its global mobility workforce by 13,000, with German plants like Reutlingen facing direct cuts as the company pivots from hardware to software.

5. The China Shock: An “Involution”

For 20 years, China was the German auto industry’s cash cow, accounting for up to 40% of profits for brands like VW and BMW. That era is over.

In 2025, we witnessed a complete reversal of fortunes. Chinese consumers have aggressively pivoted to domestic brands like BYD, Xiaomi, and Li Auto, which offer superior software and battery tech at significantly lower prices.

Market Share Shift in China: Chinese Brands vs. German Brands (H1 2025)

The Data:

- Chinese Domination: Domestic brands now control 68.8% of the Chinese market.

- German Collapse: German market share in China has plummeted to just 13.1% (H1 2025).

- EV Irrelevance: In the critical EV segment, German brands (VW, Audi, BMW, Mercedes combined) hold a negligible ~5% market share in China.

Why? It’s the “Smart Cockpit.” Chinese consumers view German cars as “mechanical dinosaurs”—excellent hardware but “dumb” software compared to the seamless digital ecosystems of a Xiaomi SU7 or BYD Han.

6. The Economic Stranglehold: Energy & Costs

Why can’t Germany just lower prices to compete? Because it is too expensive to build cars there.

Since the loss of cheap Russian gas, Germany’s industrial model has been broken.

- Electricity Costs: In 2025, German industrial electricity prices hovered between €80–€140 per MWh.

- The Competitor Gap: In contrast, industrial competitors in the US and China pay significantly less (often effectively €60-80/MWh or lower due to subsidies).

This energy disparity makes energy-intensive battery production in Germany economically unviable, pushing production to Hungary, Spain, or back to China.

7. The “Software Definition” Problem

The crisis is also cultural. German engineers spent 100 years perfecting the Spaltmaß (panel gap) and the combustion engine. They missed the shift where the car became a computer on wheels.

- VW’s Software Struggle: The delays in the Cariad software division pushed back the launch of critical models like the electric Porsche Macan and Audi Q6 e-tron by years.

- The Speed Gap: Chinese OEMs update their vehicle software monthly and develop new car models in 18-24 months. European OEMs still take 48 months. In the tech world, being 2 years late is being 10 years too late.

Conclusion: Survival of the Fittest

The year 2025 will be remembered as the year the German automotive industry was forced to shrink to survive. The mass-market dominance of VW is likely gone, ceded to BYD and Tesla.

What to Watch in 2026:

- Consolidation: Expect mergers or deeper alliances (e.g., VW and Rivian, or partnerships with Chinese firms like Xpeng) to stop the bleeding.

- The Premium Fortress: Mercedes and BMW are retreating to the high-margin luxury segment, abandoning the entry-level market where they can no longer compete on cost.

For the EV enthusiast, this means more choices than ever—but fewer of them may be “Made in Germany.”

Dataset A: The 2025 Job Cuts

| Company | Jobs Cut (Announced/Executed) | Scope |

| Volkswagen | 35,000 | Germany (by 2030) |

| Bosch | 13,000 | Global Mobility Sector |

| ZF Group | 7,600 | EV Powertrain Div. |

| Audi | 7,500 | Germany (Admin/Dev) |

| Continental | 7,150 | Global |

| Ford | 4,500 | Saarlouis Plant Closure |

Dataset B: The China Market Shift (H1 2025)

| Brand Origin | Market Share | Trend |

| Chinese Brands | 68.8% | ⬆️ Surge |

| German Brands | 13.1% | ⬇️ Crash |

| German EV Share | ~5.0% | ⚠️ Irrelevant |