Up to now, the Chinese language automotive makers have no longer been coming into the markets with reasonable costs. It’s true they are able to assemble at 20% decrease prices, however they won’t be able to do business in that price degree in Europe. They want to spend a accumulation of cash on adapting cars to Ecu laws in addition to construction a gross sales community. The costs of the Chinese language automobiles introduced in Europe are two times as dear in comparison to the ones in China, stated Volkswagen Staff CEO, Oliver Blume, commenting on Chinese language manufacturers coming into the Ecu markets.

The Chinese language automotive producers aren’t a blackmail for the Ecu corporations. Within the pace decade, they’ve discovered the right way to form automobiles, however we’ve got automotive technology, degree of constituent and a logo heritage, so we see ourselves neatly situated, persevered the CEO, who sees the prices as a subject matter for VW’s electrical portfolio. We want to paintings dry on decreasing the prices, however we’re assured that they are able to be decreased temporarily, stated the CEO.

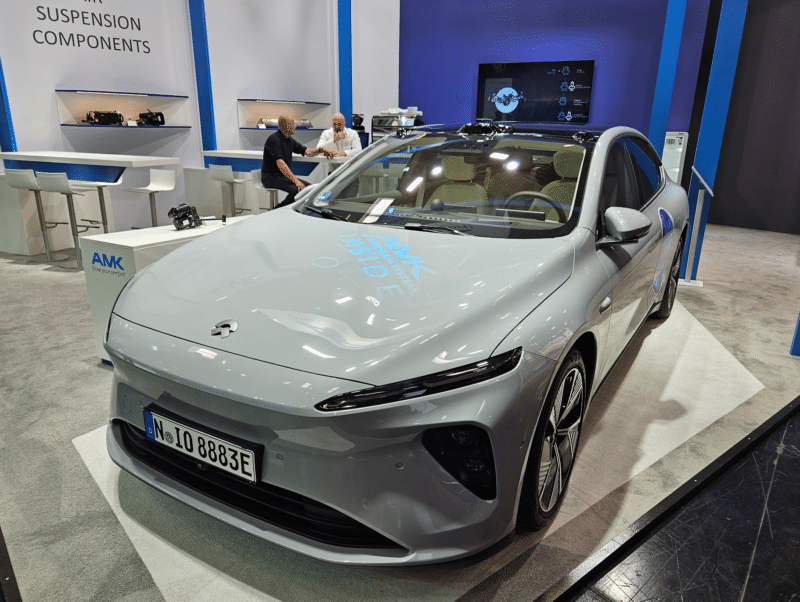

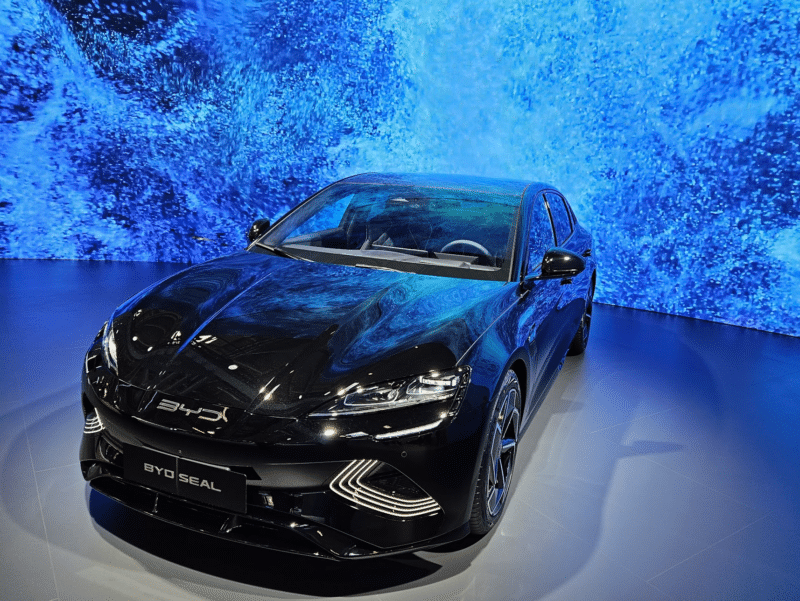

In line with Blume’s phrases, till the corporate is in a position to trim prices and entire a construction of its electrical portfolio, Volkswagen can depend on interior combustion engine cars (ICEV) fashions to finance the transition. In contrast to Nio or BYD, the German automotive maker can depend at the cash from ICEV department to speculate the cash wanted for the ramp-up of electrical mobility, natural EV manufacturers would not have that possibility, they want to search for financing, defined the CEO.

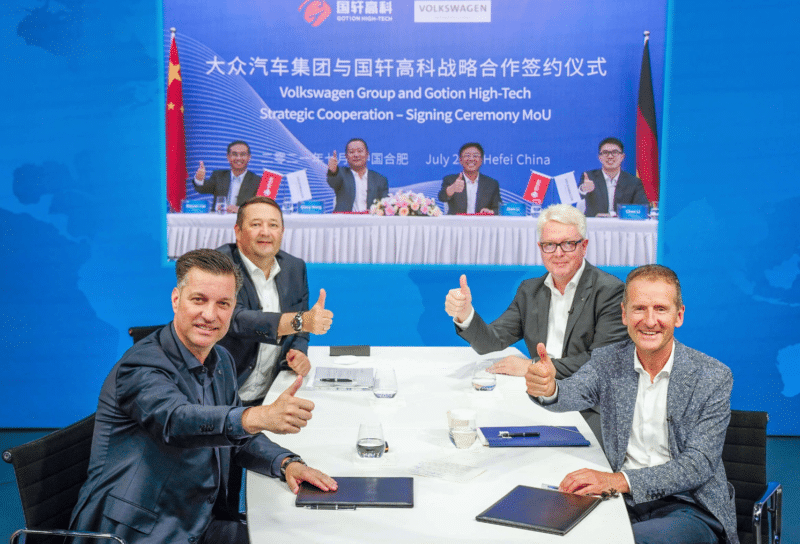

The prices CEO discussed are anticipated to be trim through 50% for the access cars as soon as the producer’s unified mobile is advanced. The theory in the back of the battery is to have one mobile design that may preserve over 80% of the corporate’s portfolio through 2030. The battery is being advanced with a Chinese language battery producer, Gotion. The Hefei battery maker may also take part in development of Saltzgitter plant. In Would possibly, Gotion stated the unified mobile plant that may assemble 10 GWh of ternary and 10 GWh of lithium-iron phosphate (LFP) unified cells will get started running this quarter.

The mobile is anticipated to be the usual a part of the VW’s Scalable Device’s Platform (SSP), a unmarried platform that are meant to, similar to the mobile, preserve over 80% of the corporate’s product portfolio. The tide tendencies concerning the platform are concealed. With the trade of CEO in September closing moment, the German automotive maker stated the mission rollout deliberate for 2026 has been suspension to 2028 or 2029, however after in June this moment stated the corporate objectives for 2026.

The timeline of the SSP rollout was once puzzled once more, when VW introduced purchasing a proportion within the Chinese language EV maker, Xpeng, in trade for the digital and electrical structure of Xpeng’s SUV, G9, which gross sales flopped. Xpeng may also aid the German corporate to manufacture two pristine fashions through 2026.

The G9’s powertrain makes use of China’s first 800 V mass-production Silicon Carbide (SiC) platform and comprises the business’s first full-scenario ADAS. The automobile additionally options 31 lidar sensors, twin NVIDIA DRIVE Orin-X clever assisted riding chips, and Gigabit Ethernet conversation structure, the G9 has as much as 508 TOPS of computing energy.

Together with the Xpeng do business in, VW showed cooperation between Audi and SAIC Motor. In line with the reviews, Audi is taken with SAIC’s top rate EV logo, IM Motor, and its platform which is impaired through the emblem’s fashions, L7 and LS7. The scoop at the cooperation adopted consistent delays of pristine EVs at the corporate’s Top rate Platform Electrical (PPE), which serves VW’s luxurious department in Audi and Porsche.

The platform can accommodate batteries so long as 2023 mm and backup each 400 V and 800 V electrical architectures. The platform too can accommodate cars with wheelbases ranging between 2690 mm and 3100 mm.

Supply: Automobilwoche